First-Time Property Buyers Guide: What to Know Before You Buy

Buying your first home is exciting—but it’s also a huge commitment. Beyond price and square footage, there are lots of things to consider that can save you major headaches (and money) down the line. This guide walks you through key things to look for—before you sign anything.

1. Check Out the Neighbourhood

The house may look perfect, but the area around it matters just as much.

Tips:

-

Visit at different times of day to get a feel for noise levels and safety.

-

Walk the streets, check the condition of nearby properties, and see how well the area is maintained.

-

Talk to locals if possible—they’ll give honest insight that listings won’t.

-

Research any planned developments or changes (like roadworks or new housing).

2. Consider Schools and Local Amenities

Even if you don’t have kids, good schools can impact property value.

Things to look for:

-

Quality of nearby schools (check Ofsted ratings in the UK, or GreatSchools.org in the US).

-

Proximity to shops, parks, GPs, dentists, gyms, and public transport.

-

Access to community services like libraries or sports facilities.

3. Test the Commute

Commuting time is often underestimated. What looks like a 20-minute trip on paper could be 45 during rush hour.

Try this:

-

Do a trial run during your usual work hours.

-

Check traffic or train delays using real-time apps.

-

Look into parking availability if you drive—some areas are permit-only or tough for guests.

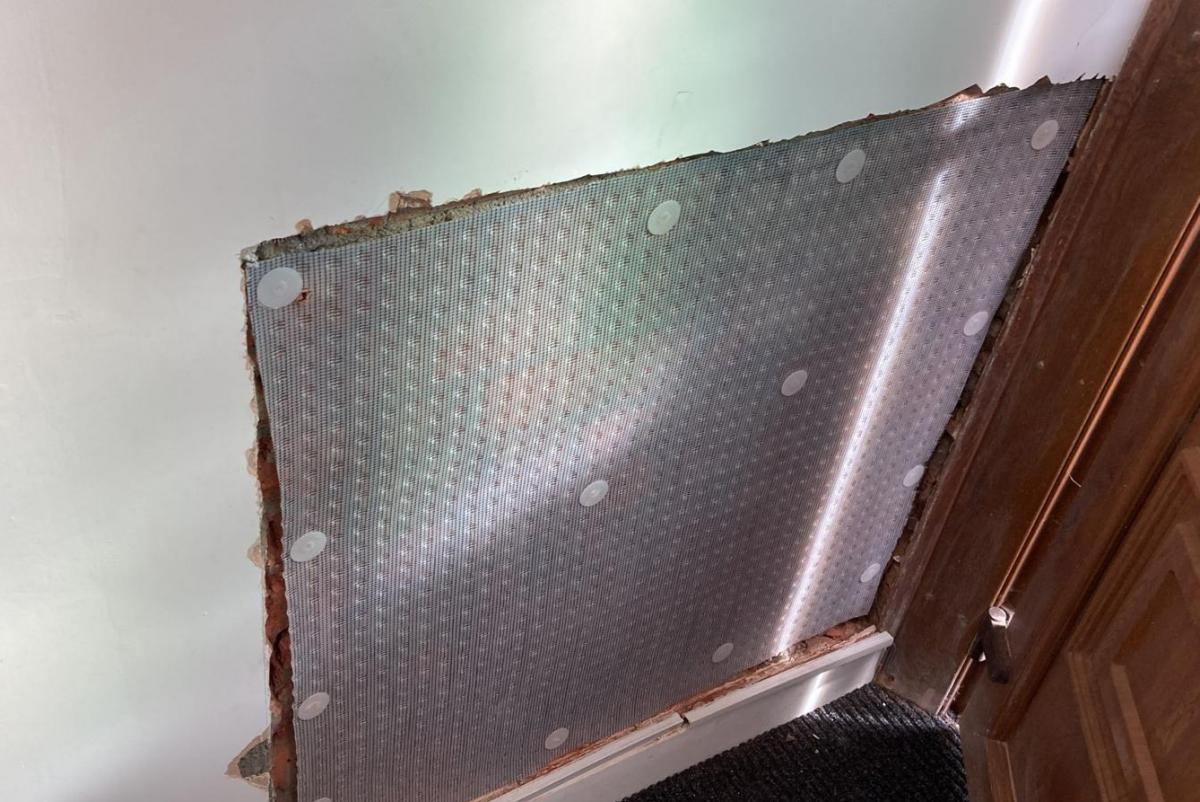

4. Don’t Skip the Structure: Inspect for Damp and Defects

The biggest—and most costly—problems in older properties are often hidden behind fresh paint or clever staging.

Look Out For:

-

Musty smells (especially in basements or near skirting boards).

-

Black mould spots or bubbling paint.

-

Discoloured patches on walls or ceilings.

-

Warped floorboards or windows that don’t close properly (could mean damp or foundation shifts).

Important: Mortgage Surveys Aren’t Enough

Mortgage valuation surveys are not the same as a full structural survey. They’re often very basic and can miss issues like subtle damp or poor insulation.

Pro Tip: Hire an independent surveyor or damp specialist if you suspect issues. It might cost more upfront but could save you thousands later.

5. Understand the Total Cost of Buying

It’s not just the deposit you need to think about.

Budget for:

-

Stamp duty or land tax (varies by location).

-

Survey costs.

-

Solicitor/conveyancing fees.

-

Moving costs.

-

Immediate repairs or decorating.

-

Council tax and utility setup.

6. Ask the Right Questions

Before making an offer, ask the estate agent or seller:

-

How long has the property been on the market?

-

Are there any known issues or previous repair work?

-

What’s included in the sale? (White goods, curtains, sheds?)

-

What’s the local broadband speed like?

7. Take Your Time and Don’t Rush

It's easy to fall in love with the first property you see, but this is a major decision.

-

Compare at least a few different properties.

-

Sleep on it before making an offer.

-

Don’t be pressured by agents into bidding fast without thinking things through.

Final Word: Be Smart, Not Just Sentimental

Buying your first home is part emotion, part strategy. Do your homework, trust your gut, and bring in professionals where it counts. It’s better to ask too many questions than face nasty surprises after you’ve moved in.